US Logistics Update [Nov 15, 2025]-English

- Nov 16, 2025

- 4 min read

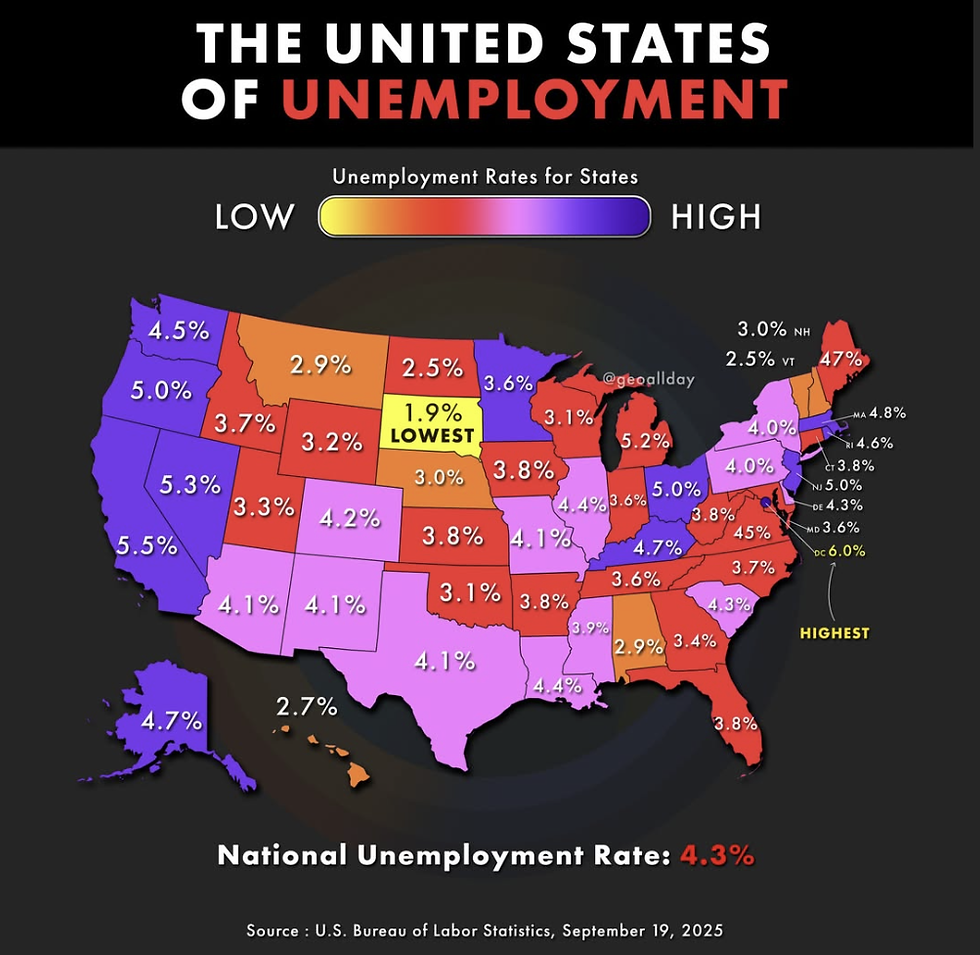

The longest federal government shutdown in history, lasting 43 days, ended on the night of November 12th. The White House ordered government employees to return to work starting Thursday, the 13th. Consequently, 600,000 furloughed federal employees resumed government operations. However, the aftermath is proving significant. Particularly significant disruption stems from the release of various statistical indicators that had been suspended for over 40 days. The halt in collecting and analyzing key monthly statistics on employment, prices, and consumer spending is expected to make it difficult to ensure the continuity and accuracy of these data. White House Press Secretary Karoline Leavitt stated at a briefing on the 12th, “There is a high possibility that the October Consumer Price Index (CPI) and the nonfarm employment report will never be released.” The CPI and nonfarm payroll report, released monthly by the Bureau of Labor Statistics (BLS), serve as key benchmarks for the Federal Reserve's (Fed) policy rate decisions. Inflation and employment are the most critical variables determining a government's fate. As artificial intelligence (AI) rapidly replaces human workers, an AI-driven ‘employment cliff’ is materializing. With uncertain statistical indicators, all eyes are on how the Fed will respond.

The National Retail Federation (NRF) forecasts that U.S. holiday consumer spending this year will increase by 3.7% to 4.2% compared to last year, surpassing $1 trillion for the first time ever, as the year-end peak shopping season begins with Thanksgiving and continues through Black Friday and Christmas. The NRF notes that overall consumer sentiment remains low due to the prolonged federal government shutdown, trade uncertainties, and persistent inflation, with a noticeable decline in spending among lower-income groups. However, it predicts that consumption polarization will drive actual spending, with increased spending by high-income groups leading to record-high year-end consumer spending. Nevertheless, the NRF's forecast of 3.7% growth represents the weakest year-end sales growth rate recorded over the past six years. Meanwhile, Bloomberg reported that retailers are expected to absorb some tariff costs to prevent sharp price hikes on essential goods.

North American Vessel Dwell Times

California Cancels 17,000 Immigrant CDLs… Federal-State Clash Over Non-Resident Licenses

California's cancellation of 17,000 non-domiciled commercial driver's licenses (CDLs) issued to immigrant drivers has intensified the conflict over the federal Department of Transportation's (DOT) non-domiciled CDL regulations and English language proficiency (ELP) standards. Notably, DOT Secretary Sean Duffy first disclosed the CDL cancellations, calling them “illegally issued.” California Governor Gavin Newsom's office countered, stating the revocations were due to “inconsistencies with state law” and that all affected drivers were legal residents with work authorization. The new federal regulations concerning CDLs and ELP could prevent renewals for up to 194,000 nonresident CDL holders and restrict CDL acquisition for legal immigrants, including refugees, causing significant industry concern. Meanwhile, the DOT's new nonresident CDL regulations are embroiled in legal battles after the U.S. Court of Appeals for the District of Columbia Circuit issued an order temporarily halting administrative enforcement while a related lawsuit is pending. While no significant impact has yet been felt in logistics operations, reports indicate a somewhat tighter truck supply on some long-haul routes at Southern California ports like LA and LGB, drawing attention to potential future ripple effects.

Uber Freight Challenges Last-Mile Market... Crack Appears in FedEx·UPS Dominance

Uber Freight is accelerating its push into the last-mile logistics market, signaling a potential crack in the parcel delivery landscape dominated by FedEx and UPS. Uber Freight announced it will expand its partnership with delivery platform provider Better Trucks and leverage the company's logistics center, sorter center network, and technology to strengthen Uber's last-mile capabilities. Amid growing demands from shippers for cost savings due to tariff burdens and slowing demand, Uber Freight is strategizing to enter the market by emphasizing ‘low cost’ alongside its existing strengths of ‘speed and reliability’. Shippers are reducing service providers to cut transportation costs and seeking alternatives to high-cost carriers like UPS and FedEx for parcel and freight shipping. The industry is watching to see if Uber Freight can emerge as a new last-mile alternative carrier challenging the FedEx and UPS system, which has implemented annual rate increases.

FAA Expands ‘Flight Suspension’ to Include DC-10 Series Following UPS MD-11F Crash

The U.S. Federal Aviation Administration (FAA) has not yet lifted the flight suspension imposed after the UPS MD-11F cargo plane crash. Instead, it has expanded the ban to include the DC-10 and MD-10 series, which are part of the same family, amplifying industry concerns. On November 4, UPS Airlines Flight 2976, an MD-11F cargo aircraft, lost control shortly after takeoff from Louisville Airport in Kentucky, USA, when its left engine pylon—the component connecting the engine to the fuselage—separated from the wing. The aircraft crashed into a nearby industrial park, killing all 14 people on board, including the three crew members. The FAA issued an Emergency Airworthiness Directive immediately after the accident, grounding all MD-11 and MD-11F aircraft registered in the United States until additional inspections and corrective actions were completed. Prior to this, UPS and FedEx voluntarily grounded their entire fleets of MD-11 freighters (UPS: 26 aircraft, FedEx: 28 aircraft, Western Global: 4 aircraft) as a ‘precautionary measure’. The FAA stated that the potential structural defect in the MD-11 “may exist or occur in other aircraft sharing the same type design,” and will not permit resumption of operations until detailed inspections and specific maintenance/reinforcement plans are finalized. Furthermore, the FAA amended its emergency directive on November 15, expanding the grounding to include MD-10 and DC-10 series aircraft with similar engine-pylon structures. This includes the MD-10-10F, MD-10-30F, DC-10-10, DC-10-30, military KC-10A, and modified KDC-10 variants. Some industry observers assess that this action has effectively placed the MD-11 family in a state of ‘indefinite grounding’ within the global cargo network, including UPS and FedEx. They anticipate that the possibility of resuming operations in the short term is low, as the FAA has not yet clearly specified the required inspection and improvement details or the criteria for resuming flights.