US Logistics Update [Dec 20, 2025]-English

- Dec 21, 2025

- 5 min read

Updated: Jan 2

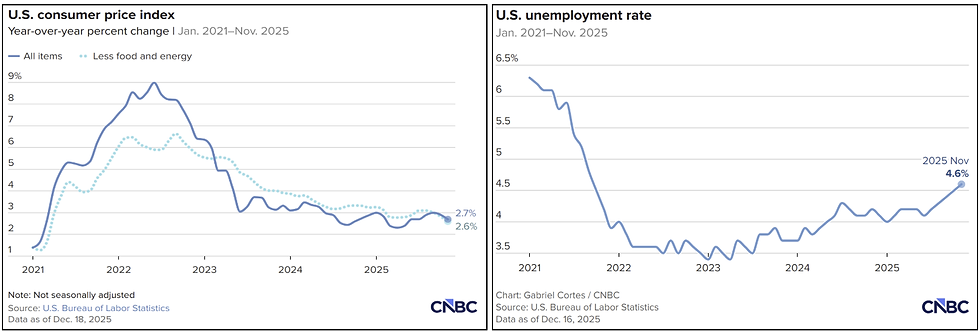

The U.S. Bureau of Labor Statistics (BLS) announced that the Consumer Price Index (CPI) rose 2.7% year-over-year in November. This figure fell short of the 3.1% forecast by experts and was lower than September's 3.0% increase. The core CPI, excluding volatile energy and food prices, rose 2.6% year-over-year, a significant drop from September's 3.0%. Bloomberg News analyzed that this could be interpreted as a sign of respite from the persistent inflationary pressures that had persisted for months at the slowest pace since early 2021. However, CNBC reported that while the figure could fuel investor expectations that easing inflation pressures might prompt monetary policy relaxation, caution against overinterpretation is warranted. Given the relatively limited data available for analysis, it may be premature to declare November's CPI the start of a sustained inflation decline. The actual October CPI data was not compiled due to the federal government shutdown, and the November data was also compiled with insufficient analytical data, sparking controversy over statistical distortion. Regardless, U.S. inflation continues to run at around 3%, a high level compared to most other countries. Additionally, the November unemployment rate rose sharply to 4.6%.

President Trump announced on the 17th, marking the first anniversary of his second term, a surprise plan for the largest-ever tax rebates next spring and special dividend payments for military personnel. He confirmed plans to issue a $2,000 per person ‘tariff rebate’ next year and began discussions with Congress on the approval process. The $2,000 tariff rebate is a significant amount, paid per person rather than the initially anticipated $2,000 per household, meaning a family of four would receive $8,000. Meanwhile, he announced that 1.45 million active-duty military personnel will also receive a $1,776 per person ‘Warrior Dividend’ before Christmas. President Trump's decision to introduce such a robust cash support measure is analyzed as stemming from his judgment that his approval rating (36% - PBS, NPR poll), his job approval rating (38%), and opposition to his economic policies (57%) have reached crisis levels, hitting the lowest points of his entire presidency. Notably, 70% of respondents reported difficulty covering living expenses in their current area, the highest figure since the survey began in 2011.

The U.S. has signaled the possibility of revising the USMCA, drawing significant industry attention. U.S. Trade Representative (USTR) Jamison Greer stated on the 10th that some provisions could be amended during the first joint review scheduled for July next year. Greer particularly emphasized renegotiating rules of origin for non-automotive products, interpreted as a U.S. strategy to strengthen domestic production beyond the auto industry into agriculture, manufacturing, and other sectors. Experts predict that if the U.S. tightens rules of origin for non-auto goods, it could significantly alter North American supply chains and trade flows. In essence, the U.S. appears poised to expand its “Made in USA” push into broader industries during next year's USMCA review.

North American Vessel Dwell Times

Union Pacific-Norfolk Southern Merger Signals Birth of First Transcontinental Railroad in U.S.

Union Pacific (UP) is pursuing a merger with Norfolk Southern, heralding the launch of America's first transcontinental railroad company. UP submitted a massive merger application exceeding 6,000 pages to U.S. regulators on the 19th. The application includes plans to shift millions of freight shipments annually to intermodal transport, a strategy aimed at reducing reliance on road transport and maximizing rail transport efficiency, reported JOC. If this merger succeeds, the east-west transcontinental rail network in the U.S. will be consolidated under one company, with significant changes expected across the entire supply chain. Experts predict, “Strengthening the competitiveness of rail transport will simultaneously lead to reduced logistics costs and environmental benefits.”

CBP issues surge in ‘CF-28·CF-29’ import cargo queries... targeting origin and price

At an international trade symposium in Norfolk, Virginia, Eugene Rainy, CEO of the American Association of Exporters and Importers (AAEI), stated that U.S. Customs and Border Protection (CBP) is intensifying verification of importers by increasing queries on specific shipments. He mentioned that CBP is issuing a large number of CF-28 cargo information requests, which could lead to CF-29 determination notices demanding corrections for violations such as tariff classification errors, valuation adjustments, origin determinations, and FTA eligibility. He stated, “Even in the industry with long customs experience, we've never seen this many 28s and 29s on a daily basis,” calling it a major warning signal for companies. He emphasized that CBP is digging into origin determinations down to the raw material level, scrutinizing seemingly minor components like aluminum in toothpaste caps or deodorant. Gabriel Griffiths, Director at trade advisory firm BPE Global, also noted that the rise in CF-28s is “not just a perception but is actually being observed across our client base,” diagnosing that CBP is expanding targeted investigations through advanced data analytics. The industry reports a noticeable increase in CF-28 issuance over recent weeks, with Rainy noting that this enforcement ramp-up is elevating trade compliance from operational departments to boardroom and CEO-level agendas.

Top 15 Container Carriers by US Imports from Asia

(JOC, Annual containerized US Imports from Asia, in laden TEUs)

2024 Rank | Ocean Carrier | 2024 Market Share | 2023 Volumes | 2024 Volumes | YoY change |

1 | Cosco Shipping/OOCL | 16.1% | 2,549,099 | 3,062,771 | 20.2% |

2 | CMA CGM/APL | 13.9% | 2,302,944 | 2,645,672 | 14.9% |

3 | Ocean Network Express (ONE) | 11.7% | 1,925,929 | 2,230,843 | 15.8% |

4 | Mediterranean Shipping Co. (MSC) | 11.4% | 1,748,096 | 2,175,140 | 24.4% |

5 | Evergreen Line | 10.8% | 2,015,274 | 2,058,439 | 2.1% |

Top 5 Carriers by US Imports from Asia | 64.0% | 10,541,341 | 12,172,865 | 15.5% | |

6 | A.P. Møller - Maersk* | 9.7% | 1,768,312 | 1,836,385 | 3.8% |

7 | Zim Integrated Shipping Services | 5.6% | 723,818 | 1,064,545 | 47.1% |

8 | HMM | 4.9% | 805,203 | 936,961 | 16.4% |

9 | Yang Ming Line | 4.4% | 710,547 | 844,374 | 18.8% |

10 | Hapag-Lloyd | 4.4% | 620,491 | 828,348 | 33.5% |

11 | Wan Hai Lines | 2.6% | 374,754 | 494,708 | 32.0% |

12 | SM Line | 1.6% | 235,336 | 296,036 | 25.8% |

13 | Matson | 1.3% | 239,820 | 245,633 | 2.4% |

14 | Sea Lead | 0.2% | 1,824 | 46,699 | 2460.0% |

15 | TS Lines | 0.1% | 67 | 26,540 | 39500.7% |

Top 15 Carriers by US Imports from Asia | 98.9% | 16,021,512 | 18,793,095 | 17.3% | |

Total US Imports from Asia | 16,177,559 | 19,008,551 | 17.5% | ||

*A.P. Møller - Maersk includes Maersk, Sealand, Safmarine and Hamburg Süd | |||||

Source: S&P Global© 2025 S&P Global. | |||||

“Small-Value Cargo Duties Surge, Global E-Commerce Paradigm Shift”

The U.S. Customs and Border Protection (CBP) announced that duty revenue from low-value e-commerce shipments has surpassed $1 billion. The Journal of Commerce (JOC) reports that this, coupled with changes in global supply chains, explosive growth in e-commerce, and consumers' preference for overseas direct purchases, is rapidly reshaping U.S. trade structures. Meanwhile, the industry assesses this figure as “a new customs paradigm in the e-commerce era,” emphasizing that “the increase in low-value cargo customs revenue is not merely expanded tax revenue but an indicator reflecting the shifting landscape of the global e-commerce supply chain.” However, e-commerce cargo, particularly low-cost shipments from China, shifted partially to sea freight due to President Trump's tariffs. Yet, as the tariff impact on low-cost goods' prices proved minimal, demand recovered significantly, leading to a recent shift back to air freight. Continuous monitoring is needed to assess how tariff policies will affect low-cost e-commerce cargo.

Air freight rates from Asia to the U.S. continue to rise... Volume down 4%

According to WorldACD, air cargo volume from Asia-Pacific to the US during Week 50 (December 8-14) decreased by 4% compared to the previous week. Volume from China, down 8%, led the decline. However, contrary to the volume slowdown, freight rates continued to rise, with Asia-Pacific→US spot rates increasing 3% week-on-week to $6.57 per kg. Spot rates from Hong Kong surged 12% to $6.92, while those from South Korea rose 15% to $5.79 and from Singapore also climbed 15% to $6.43. The China→US market, which experienced significant volatility this year, also saw its Week 50 spot rates recover to last year's level at $6.96 per kg.

However, following the typical year-end pattern, the global average spot freight rate began to

decline slightly in Week 50, along with cargo volumes. This is interpreted as a signal that air cargo

has now “passed the peak,” as year-end restocking eases during the final weeks before the

Christmas and New Year holidays.