US Logistics Update [Aug 23, 2025]-English

- Aug 24, 2025

- 4 min read

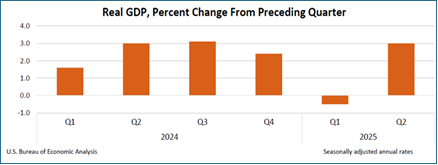

Jerome Powell, Chairman of the Federal Reserve (Fed), mentioned the economic situation in the United States, namely the slowdown in growth, employment, and inflation, which could justify an interest rate cut, in his keynote speech at the Jackson Hole Symposium on the 22nd, raising the possibility of an interest rate cut at the Federal Open Market Committee (FOMC) meeting scheduled for September 16-17. Powell pointed out that the GDP growth rate for the first half of the year was 1.2%, which is less than half of the 2.5% recorded in the same period last year. He also cited statistical indicators showing a significant decline in jobs due to the slowdown in growth, expressing concerns about rising unemployment rates. He also indirectly criticized the Trump administration's tariffs and immigration policies, saying that “significant uncertainty” has arisen in the macroeconomy, which is the basis for monetary policy decisions. In particular, regarding tariff policies, he said, “The effect on consumer prices is now clear,” adding, “We expect this to accumulate over the next few months.”

In general, the slowdown in growth and employment drives central banks to lower interest rates,

suggesting that Powell's perception has moved closer to lowering interest rates. However, even if

interest rates are lowered, it is likely to be a cautious “baby step” of 0.25 percentage points at a time,

while monitoring the economic situation, so the conflict with President Trump is expected to

continue. The New York Times evaluated Powell's speech as “the strongest signal yet that the Fed is

preparing to resume interest rate cuts,” while the Wall Street Journal reported that “Powell has

opened the door to a rate cut at next month's FOMC meeting.” The CME's Fed Watch reflected the

probability of the Fed lowering interest rates by 0.25 percentage points at the September FOMC

meeting from 75% the previous day to 83%. Expectations of interest rate cuts caused New York

stock prices to surge by more than 2%.

The Trump administration announced on August 14 that it would add 407 steel and aluminum derivative products to the list of tariff targets, effective August 18. The US currently applies a 50% tariff on steel and aluminum to most trading countries, with the exception of the UK, which is subject to a 25% tariff. With this expansion, most products will be subject to high tariffs of 50%, and consumer goods, household and industrial products, transportation and heavy industry, chemicals and coatings, and energy and infrastructure-related items are expected to be particularly affected. Of these, 124 items are classified as both steel and aluminum derivatives, requiring importers to report the type, weight, and value of the metal in the product. Automotive products will continue to be subject to Section 232 automotive tariffs (25%) and will not be subject to overlapping steel and aluminum tariffs. This measure is expected to result in higher costs for manufacturers and more complex customs procedures for the logistics industry.

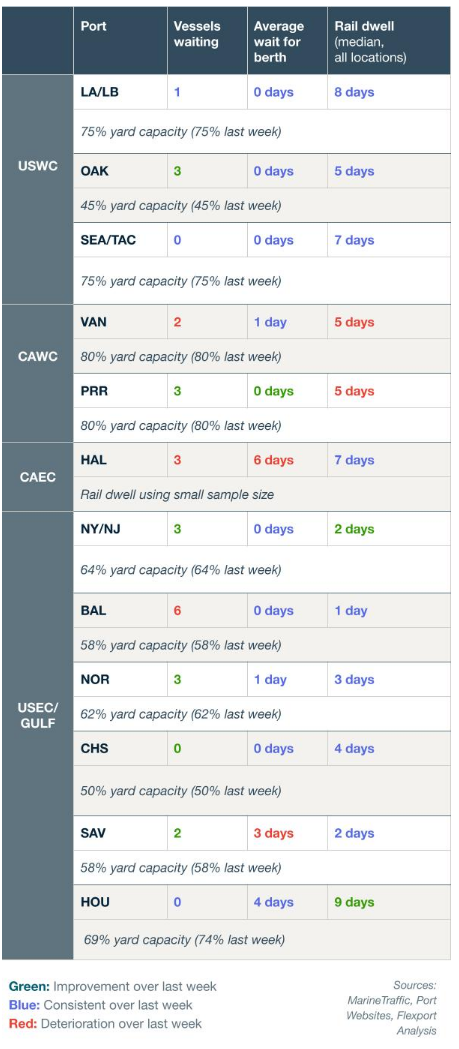

North America Vessel Dwell Times

Walmart and Target confirmed to have implemented large-scale “front-loading” strategy to avoid tariffs

Major US retailers Walmart and Target have imported a wide range of items, from Halloween and Christmas decorations to popular toys and home appliances, on a large scale in advance in response to the Trump administration's tariff uncertainty. According to data from Import Genius and Sea-Intelligence, imports at the top 10 U.S. ports from January to April 2025 increased by 15.6% year-on-year, nearly double the pre-pandemic peak (8%). Target began bringing in shipments ahead of the Lunar New Year holiday in January, while Walmart reached its peak in March. When the Trump administration reduced tariffs on Chinese products from 145% to 30% in May, orders that had been temporarily suspended resumed, causing a sharp increase in shipments arriving in the US in June and July, followed by a sharp decline in August. Many experts analyze that “the preemptive shipping strategy may impose significant short-term costs, but it is a way to ensure supply chain stability and predictability.”

US imports hit record high in July... Slowdown expected in the future

US imports in July surged 17.5% year-on-year to 2.609 million TEU, surpassing pandemic-era cargo volumes and reaching a record high. According to PIERS data, cumulative imports from January to July this year also increased 5.4% year-on-year. This surge is attributed to expanded shipments from Southern Europe and Southeast Asia, as well as early shipment securing (frontloading) due to tariff uncertainties. Experts anticipate that the U.S. import market will significantly slow down in the second half of the year due to the ripple effects of companies' proactive shipping. This is analyzed as resulting from the peak season effect already being exhausted and shippers becoming cautious about additional orders due to rising consumer prices.

Global postal services suspend parcel deliveries to the US... Impact of De Minimis termination

With the US abolishing its De Minimis tax exemption rule for parcels worth less than $800 on August 29, postal authorities in many countries, including South Korea, Singapore, Norway, Finland, the UK, and Belgium, have announced that they will suspend accepting regular parcels bound for the US. This is due to uncertainty surrounding customs collection methods and customs data submission procedures. Many airlines, including Lufthansa and Korean Air, have also suspended parcel transportation. However, deliveries via private express carriers such as FedEx, UPS, and DHL are proceeding without issue.